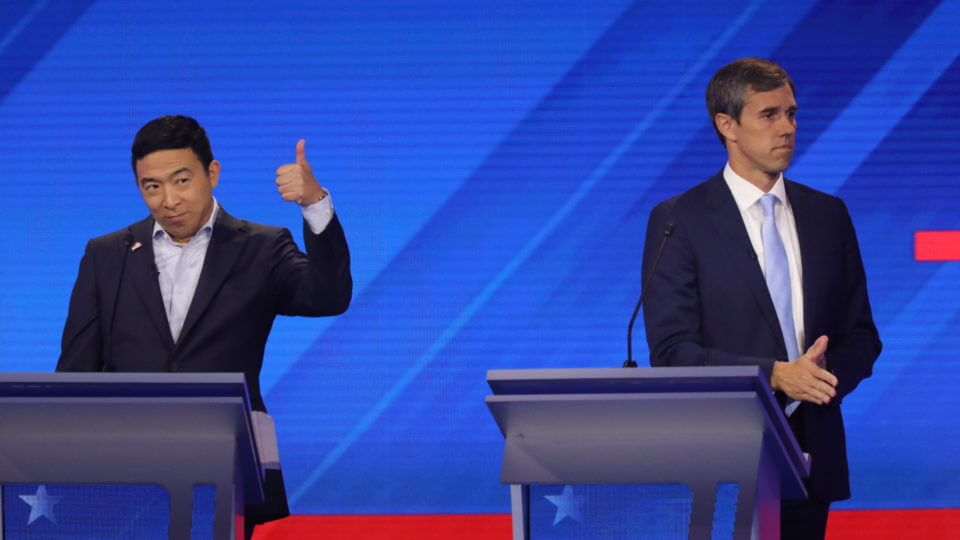

“The outcome of Andrew Yang’s UBI would be higher rents and, most likely, a property bubble.”

How would you spend the Universal Basic Income (UBI) currently being proposed by Democratic presidential candidate Andrew Yang? Hard to say? Well, how do you spend your current income? What is your biggest expense? Rent? Mortgage? Probably. Or maybe you live with family members because real estate is too expensive. You could find your own place with a UBI. Whatever the case, it’s fair to assume that a large proportion of a UBI would be spent on real estate.

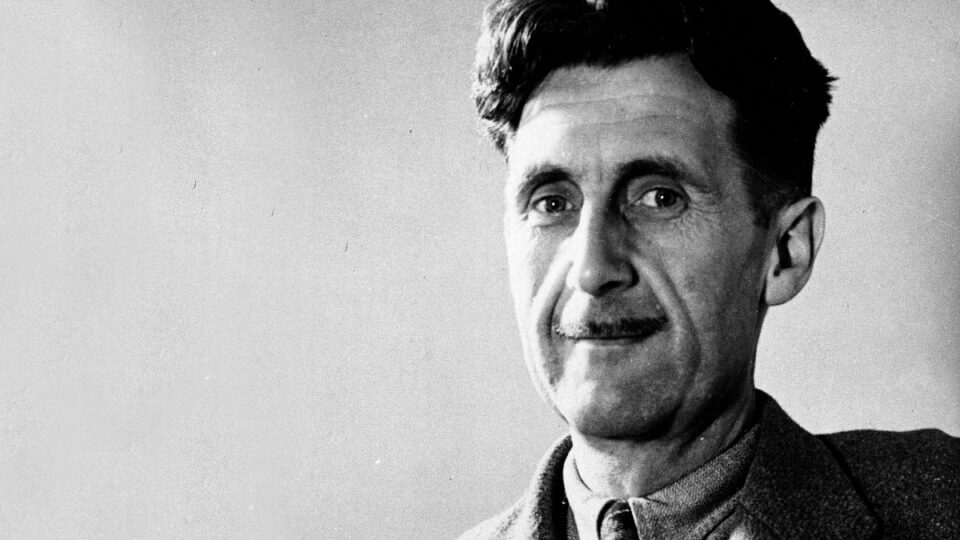

In 1909, Winston Churchill, who was a member of the Liberal Party at the time, formed the Budget League in order to counter the newly formed Budget Protest League. In British politics, the budget does not normally provoke such extreme reactions, but that year’s “People’s Budget” was different because it proposed a new principle of taxation: land value taxation (LVT), which was seen by many liberals as the key to abolishing poverty. The People’s Budget was ardently opposed by many conservatives who saw it as levying unprecedented levels of taxation on wealthier members of British society. Between July and November, the Budget League held nearly 4,000 meetings and distributed 17 million leaflets and posters, and Churchill spoke persuasively on the need for land value taxation at a speech given at King’s Theater in Edinburgh:

“…[Previously] I attempted to draw a fundamental distinction between the principles of Liberalism and of Socialism, and I said Socialism attacks capital, Liberalism attacks monopoly. It is from that fundamental distinction that I come directly to the land proposals of the present Budget…

Some years ago in London there was a toll bar on a bridge across the Thames, and all the working people who lived on the south side of the river had to pay a daily toll of one penny for going and returning from their work. The spectacle of these poor people thus mulcted of so large a proportion of their earnings offended the public conscience, and agitation was set on foot, municipal authorities were roused, and at the cost of the taxpayers, the bridge was freed and the toll removed. All those people who used the bridge were saved sixpence a week, but within a very short time rents on the south side of the river were found to have risen about sixpence a week or the amount of the toll which had been remitted!..

And a friend of mine was telling me the other day that, in the parish of Southwark, about 350 pounds a year was given away in doles of bread by charitable people in connection with one of the churches. As a consequence of this charity, the competition for small houses and single-room tenements is so great that rents are considerably higher than in the neighboring district!”

In the examples above, welfare spending generated increased demand for local real estate; consequently, prices rose. It is the same now under our present tax systems; increased welfare—once spent—goes in, large part, to landowners. The outcome of Andrew Yang’s UBI would be higher rents and, most likely, a property bubble.

As Churchill also discussed in those same 1909 remarks:

“It does not matter where you look or what examples you select, you will see that every form of enterprise, every step in material progress, is only undertaken after the land monopolist has skimmed the cream off for himself…All goes back to the land, and the land owner, who in most cases is a worthy person, utterly unconscious of the character of the methods by which he is enriched, is enabled with resistless strength to absorb to himself a share of almost every public and every private benefit, however important or however pitiful those benefits may be.”

The UBI idea can be traced back to the early 16th century of the writings of Thomas More and a few contemporaries. It gained further attention in Thomas Paine’s 1797 pamphlet Agrarian Justice. Yang even name-dropped Paine in his February, 2019 interview with Joe Rogan. But Yang does not mention the fact that Paine specified land value taxation (LVT) as the funding source for a UBI. A century after Paine, Henry George did the same. Both made it clear that a UBI must go hand-in-hand with LVT. LVT would prevent the scenarios described by Churchill above. It would ensure that that portion of land value attributable to public spending would return to the public purse. Moreover, LVT would link the tax take to productivity and, thus, address Yang’s core concern: the effect of automation on wages and employment. A UBI funded by LVT is the organic solution to this question, but Yang has yet to seriously engage with that proposal. As Fred Foldvary, an economics professor at San Jose State University, has indicated:

“The way to implement basic income without stifling employment and growth is to tap a source that does not flee, shrink, or hide when paid. That source is land rent. The three-dimensional spatial land we live in was provided by nature, and in effect, nature says, ‘Here, humans, is a free source of public revenue for your public goods and basic incomes.’ But people and their governments reply, ‘No thank you, O nature. We shall give this surplus to landowners as a special privilege. To pay for public goods, we will penalize labor and enterprise with high taxes.'”

I have seen no contemporary discussion of UBI that mentions LVT.

Is it amnesia or phobia?.

Darren Iversen is an independent student of Georgist history in England.

Cool article. Another key concern of Yang is to force corporations to pay tax… any tax. It’s unclear to me how an LVT makes Amazon pay anything. Perhaps a VAT and an LVT?

Amazon has a tremendous amount of real estate and as the recent search for a new headquarters demonstrates, it specifically requires real estate in major metropolitan areas, where the value of real estate is exceedingly high. Thus, Amazon would pay significantly under land value taxation. VAT rests mostly on consumers. Hypothetically, income tax could hit amazon harder than LVT, but since globalization income taxes have proven easy to evade. Because land is situated in a single place and can’t be out sourced, it is seemingly the best means remaining today to secure tax revenue from corporations.

As Churchill said “Socialism attacks capital, Liberalism attacks monopoly.” LVT is liberalism, VAT is socialism.

I’ve enjoyed reading your articles as they seemed quite knowledgeable, so this comment really surprised me;. “VAT is socialism”? VAT is a type of tax that hurts low income families the most, gets passed to the consumer, and does nothing to engage with the power structures that exist between labour and capital. In large parts of Europe it was first levied by liberal or conservative governments, for the reason of paying the (consequences of) imperialist wars.

I did hesitate a bit before I posted that but VAT is a form of income tax and a tax on income constitutes the socialisation of private wealth. Wages should be completely privatised. imo