“Another problem of Friedman’s analysis is the way that he, like many neoliberals, condemns government intervention, yet is nevertheless willing to take credit for all of the positive gains it has accrued.”

Introduction

In his scathing Sturm und Drang takedown of the 1851 French dictatorial coup, The 18th Brumaire of Louis Napoleon, Marx remarks that history repeats twice: “the first time as tragedy, the second time as farce.” Thus, when Luther pit himself against the Catholic establishment, he put on, according to Marx, “the mask of the Apostle Paul.” Likewise, the French Revolution of 1789-1814 “draped itself alternately in the guise of the Roman Republic and the Roman Empire.” And to Marx’s chagrin, the latter guise, in particular, enjoyed a revival under Louis Napoléon Bonaparte, who drew on it relentlessly to rationalize his retconning of the Napoleonic legacy.

Marx, in his essay, focuses understandably on the evocations of the past that had acquired political significance in France. France continues, even to this day, to be partially gripped by nostalgia for the revolutionary heroism requisite to the establishment of an ostensibly neo-Roman Republic. In the years from 1979-2007, the Anglo-American world, skewing toward unfettered free markets, came to embrace its own brand of historical nostalgia: that of the English Enlightenment. Against the evils of the growing welfare state, what became known as neoliberalism governance was initially invoked as a return to a laissez-faire order dominant throughout the 19th century.

To this day, apologists like Samuel Gregg argue that the night watchmen state of the 19th century Anglo-American world left markets alone to bring about an unmatched order of global prosperity and development. This ideal order was challenged by redistributive efforts through the mid 20th century and only began to gain traction again in the 1970’s and 80’s, when intellectuals like Friedrich Hayek and politicians like Margaret Thatcher surged to popularity and power. By the 1990’s, with the establishment of international legal regimes via institutions such as the WTO, neoliberalism seemed unstoppable. Indeed, figures like Francis Fukuyama famously declared the “end of history,” arguing that neoliberalism’s triumph was so complete there could be no genuine competing ideologies.

Of course, all good things must come to an end. Since the “Great Recession” of 2007-08, neoliberalism’s popularity has been waning across the globe. Right-wing populists—what we have elsewhere called postmodern conservatives—are emerging across the globe to challenge neoliberalism’s internationalism. They fetishisize the market economy and engender mass migration and cultural change. Many neoliberals have expressed surprise at these developments; they were confident in the Hayekian gambit that they staked the international order upon (that the mass of people would accept massive inequality and social transformation in return for a gradually improving standard of living), but now it seems like a bust. Some might attribute this development chiefly to the impact of the Great Recession, which destroyed millions of lives across the globe. And indeed, we do not intend to undervalue the Recession’s impact as a catalyst, but it is essential to understand that the failings of neoliberalism run much deeper. It was characterized by an array of internal contradictions that, indeed, have the air of farce.

To show why, we will begin by demonstrating the superficiality of neoliberal ideology, even relative to the Enlightenment forebears they invoked but rarely appreciated. This is an aspect of a broader project to demonstrate why neoliberal doctrines were riven by intellectual failings and practical challenges from the get go, which were often masked by their transient success as a system of hegemonic global governance. Looking at where neoliberal authors were blind to problems demonstrates why the system is faltering as a capitalist project even on its own terms.

Neoliberalism and Classical Political Economy

“Whenever the legislature attempts to regulate the differences between masters and their workmen its counsellors are always the masters. When the regulation, therefore, is in favour of the workmen, it is always just and equitable; but it is sometimes otherwise when in favour of the masters.”—Adam Smith, The Wealth of Nations

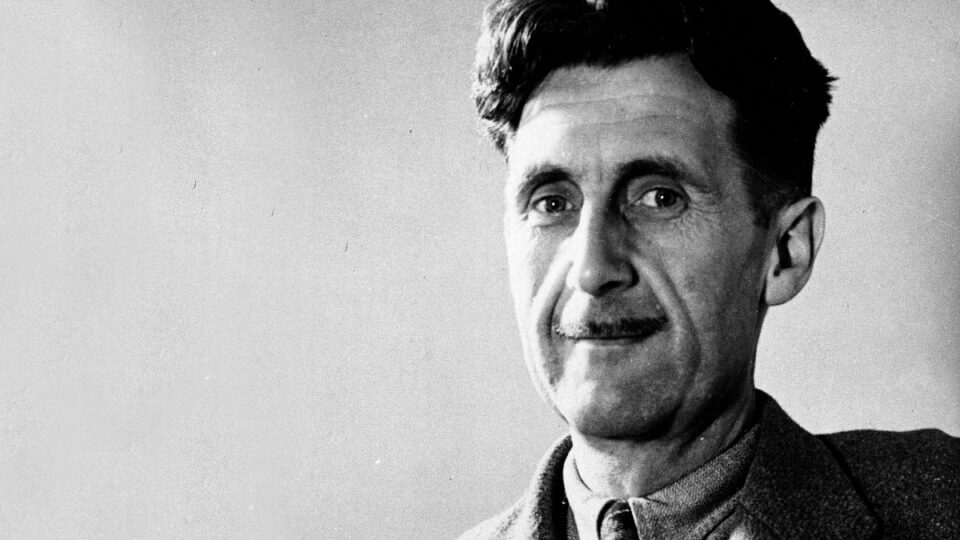

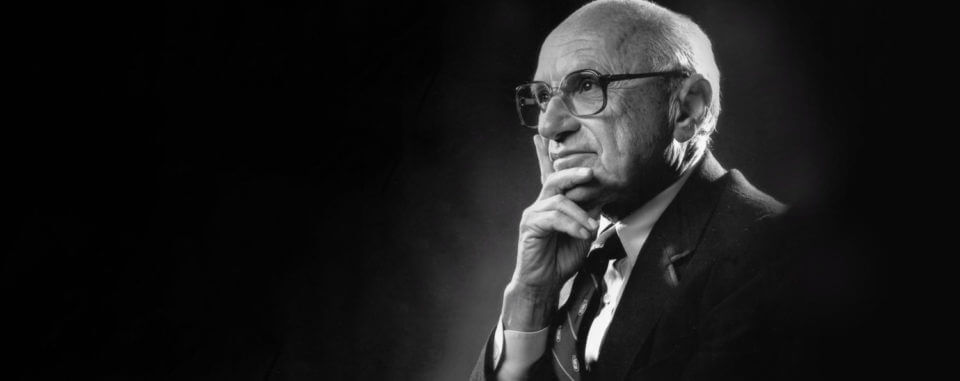

While the ideas of Hayek and Friedman indeed bear a superficial resemblance to those of Enlightenment thinkers such as Adam Smith, their efforts to cast themselves as their successors are, in a crucial sense, disingenuous. In this short article, we will focus on describing the difference between the works of Adam Smith and Milton Friedman. This is because few authors better highlight the distinction between the comparative rigor of classical political economy, even when endorsing nascent capitalist dynamics, against the more stridently ideological accounts of the neoliberals.

In The Wealth of Nations, Smith, while supportive of the liberalization of laws impeding trade, insists on the importance of the role of government in complementing the function of the market. Smith, a beneficiary of the rich intellectual climate of eighteenth-century Scotland—itself in large part a product of the Scottish government’s levying of taxes to finance schools, including for the poor—argued that governments should pay for the construction of, among other things, schools, bridges, and roads. He also makes the point throughout the text what has been described as the “invisible hand”—the capacity of individuals to enhance the welfare of the collective through the pursuit of their own ends—can only manifest within a society in which the authority of the private sector is held in check, due to the fact that its interests are “always in some respects different from, and even opposite to, that of the public.”

In the hands of Milton Friedman, Smith’s ideas undergo a considerable metamorphosis. While Smith stresses the need for intelligent private sector regulation, Friedman, by contrast, espouses something closer to a free market absolutism—one limited only by his call for a negative income tax to ameliorate extremes of poverty and his acknowledgement of the occasional need for public sector monopoly, as in military defense (though even this Friedman blames on socialists, in the form of “the threat from the Kremlin”). Barring these exceptions, in Friedman’s view, seemingly all forms of government-provided social security and regulation—from social housing to state licensure—can be either privatized or abolished.

In an effort to reinforce his claim that the private sector is far more efficient than the public one across virtually all sectors, Friedman also attempts to disprove what he views as the foundational myth of the American welfare state by alleging that the Federal Reserve severely mismanaged the money supply during the Great Depression. This argument, however, is highly selective and revisionist; while Friedman blames the Great Depression on the Federal Reserve’s allowing of the money supply to fall by one-third from 1929-1932, he fails to examine the significant role played by the Roosevelt administration’s 1934 Gold Reserve Act in expanding the American money supply.

Friedman’s commentary on the New Deal is by no means the only part of Capitalism and Freedom that is deeply flawed. In the seventh chapter of the book, “Capitalism and Discrimination,” Friedman argues that the free market is a socially equalizing force due to its indiscriminate nature, and that minorities wrongfully “attribute to capitalism the residual restrictions they experience rather than to recognize that the free market has been the major factor enabling these restrictions to be as small as they are” (an utterly hilarious notion, given that Friedman here appears to be pitting his book against the actual political experience of all social minorities). There is something to be said for this argument—one not so dissimilar to Marx’s claim that the “the bourgeoisie, wherever it has got the upper hand, has put an end to all feudal, patriarchal, idyllic relations.”

But, by making the sweeping assertion that “the preserves of discrimination in any society are the areas that are most monopolistic in character, whereas discrimination against groups of particular color or religion is least in those areas where there is the greatest freedom of competition” Friedman 1) classifies all governments as de facto more discriminatory than the private sector, and 2) treats the question of “freedom of competition” ahistorically. The problems with this are manifold. As for point 1), it is clear that, in many cases, governments have been able to successfully counteract private-sector discrimination, as is witnessed, in an American context, by the large number of African-Americans who found employment with the American government due to its relatively aggressive enforcement of fair employment practices after the 1964 Civil Rights Act. Regarding point 2), it should be remembered that the principle of “freedom of competition” is often used to uphold policies which are explicitly discriminatory in nature (just consider the “right” of slave-owners to hold slaves as property prior to the Emancipation Proclamation!).

Another problem of Friedman’s analysis is the way that he, like many neoliberals, condemns government intervention, yet is nevertheless willing to take credit for all of the positive gains it has accrued. This is in sharp contrast to Smith’s position in The Wealth of Nations. Smith was far more sensitive to the way in which government often played a fundamental role in securing the rights and property of capital, often through dramatic and unwarranted intervention. As the quote at the start of this section indicates, he felt this was a disaster. It meant that capital was able to use government to secure its interests, often at the expense of their workers and the population as a whole. This is part and parcel of why Smith believed the state may have a crucial role to play in assisting workers to ensure they had opportunities for flourishing outside of work and also is foundational to his arguments for breaking up monopolizing tendencies where they arise. Contrast this with the comparative silence of figures like Friedman when government efforts succeed in ameliorating the conditions of the worst off, with the often shrill reaction which occurs when redistributive efforts harm the interests of capital even marginally.

For instance, Friedman argues that there is “drastically less inequality” in “Western capitalist societies like the Scandinavian countries, France, Britain, and the United States” than “in a status society like India or a backward country like Egypt” (and, Friedman speculates in lieu of data, maybe even in Russia). Yet so far if this is true, it would only be the case, historically, due to the combination of developed capitalist industry and redistributionary measures imposed by the government (keep in mind that when Friedman wrote Capitalist and Freedom, the highest marginal tax rate in the United States was 94% in 1944 and 1945).

Similarly, Friedman notes that while John Stuart Mill remarked in 1848 that “mechanical inventions [have not yet] lightened the day’s toil of any human being,” the “chief characteristic” of “progress and development over the past century is that it has freed the masses from backbreaking toil and has made available to them products and services that were formerly the monopoly of the upper classes, without in any corresponding way expanding the products and services available to the wealthy.” But it never occurs to Friedman, even fleetingly, that the capacity of the populace at-large to enjoy the wealth created by more advanced capitalist production may owe to the adoption throughout the developed world of more extensive redistributive measures. Adam Smith, let alone Karl Marx, would certainly not have been so blind.

Conclusion: Neoliberalism, Postmodern Conservatism, and the Contradictions of Praxis

There are many more contradictions that could be dissected within Capitalism and Freedom—just one of several canonical neoliberal tomes. But in sum, we can say that Capitalism and Freedom contributed to the reinforcement of two significant economic fallacies, which have been devastating in practice. The first of these is that lowering taxes would not lead to significantly heightened inequality—a point Friedman makes repeatedly throughout the text. The second is that the pathway to development lies in a program of full-scale deregulation. The latter notion, in particular, came to influence the “free trade” frenzy of the 1980’s and 1990’s, as nations both rich and poor eagerly ceded portions of their sovereignty to wed themselves to transnational trade agreements on the basis of the belief that they only stood to benefit.

On the proving ground of reality, however, both these assumptions proved problematic. On one hand, it’s clear that the lowering of tax rates in the Western capitalist nations described by Friedman—as well other factors, such as anti-inflationary monetary policy and a lowered birth rate—has indeed contributed to a significant rise in inequality, with nations such as the United States and the United Kingdom now backsliding into Dickensian disparities between rich and poor (and facing correspondent political destabilization). On the other hand, the irony of international free trade is that the countries that have most succeeded in enriching themselves—such as Japan and China—have maintained varyingly stringent regimes of capital controls to prevent national income from falling considerably below GDP (or in other words, to prevent foreign takeover leading to the excessive payment of rents abroad). By contrast, regions such as Africa—which lacked the sovereignty to impose said controls—now must contend with a full-blown neocolonialism—one in which as much as 40-50% of all manufacturing capital is foreign-owned.

No surprise, then, that the public of the Western capitalist nations at large—no longer able to bask in the credit bubble that sustained their living standard prior to 2008-09—are suffering from deep neoliberal fatigue. While the turn towards postmodern conservatism as an alternative is deeply disturbing, it is not entirely surprising. As observed by Slavoj Zizek, the Left must recognize that, beneath the banality of its xenophobia, lies, and vulgarity, postmodern conservatism can initially propose policies which seem attractive to individuals who have suffered under neoliberalism and its contradictions. Trump, for instance, frequently criticizes the liberal economic programs supported by so-called “elites.” Those on the Left must understand this if they are to grasp fully the initial appeal of postmodern conservative doctrine. Where we need to be critical is observing that, even where they propose superficially attractive policies, many of these figures have little intention to implement progressive measure.

In practice, Trump’s domestic policies, such as ending Obamacare and lowering tax rates, disproportionately favor fiscal dumping, and thus the jet set class he regularly rails at. Only on the question of foreign trade—beholden as it is to a system of regulations that nations like China have deftly exploited to prevent foreign annexation—has Trump, likely sensing the diminishing gains associated with it, elected to upset the Republican status quo (fixating on the gamesmanship of other countries also helps Trump, as Thomas Piketty has observed, distract from his plutocratically-directed domestic policies). Postmodern conservatives are a false solution to real problems and can only be counted on to deliver a politics of dishonesty and division. Only a genuine progressive alternative can provide true solutions to the contradictions engendered by neoliberal doctrine and policy.

The liberal economic policy dreamt up by the English Enlightenment ended in tragedy—a dramatic heightening of industrial productivity coupled with the impoverishment of the populace at large. This conflict was only subdued with the foundation of the welfare state. More recently, the existence of the social state helped prevent the 2007-08 recession from becoming a re-run of the Great Depression, as regular state payments and stimulus packages aided in offsetting the impacts of a pervasive confidence failure. Neoliberal hegemony, then, ends in farce: as a diminished force within an economic establishment that’s only managed to save itself through bathing in the chilly waters of socialization.

Conrad Bongard Hamilton is a PhD student based at Paris 8 University, currently pursuing research on non-human agency in the work of Karl Marx under the supervision of Catherine Malabou. He is a contributor to the text What is Post-Modern Conservatism, as well as the author of a forthcoming book, Dialectic of Escape: A Conceptual History of Video Games. He can be reached at konradbongard@hotmail.com, and a catalogue of his writings can be found on Academia.edu.

Matt McManus is currently Professor of Politics and International Relations at TEC De Monterrey. His book Making Human Dignity Central to International Human Rights Law is forthcoming with the University of Wales Press. His books, The Rise of Post-modern Conservatism and What is Post-Modern Conservatism, will be published with Palgrave MacMillan and Zero Books, respectively. Matt can be reached at garion9@yorku.ca or added on Twitter via Matt McManus@MattPolProf