What did the Republicans actually do when they “killed” Dodd-Frank?

House Republicans last Thursday passed the Financial CHOICE Act, a bill designed to roll back many of the regulations in the 2010 Dodd-Frank Act. This represents just another step by Republicans under the Trump administration to dismantle many of former President Obama’s signature pieces of legislation.

The CHOICE Act, though about a quarter the length of the law it aims to reign in, is 587 pages long and contains a number of provisions including harsher SEC penalties on Wall Street fraudsters, increased legislative control over executive financial regulatory agencies, and major changes in the Consumer Financial Protection Bureau.

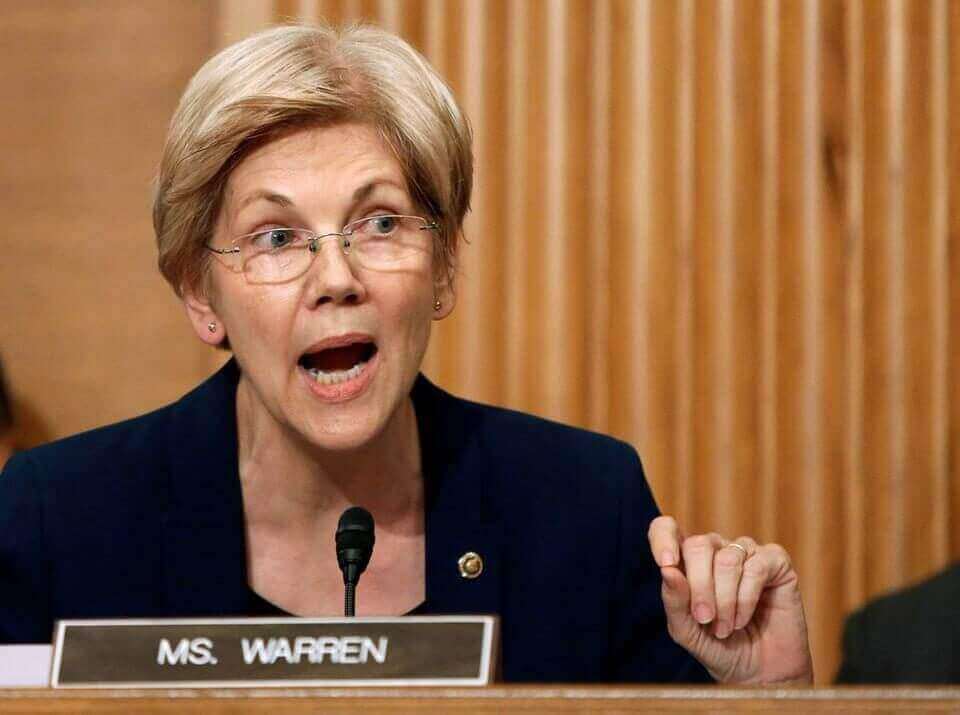

The meat of the bill, however, centers around the repeal of both the Department of Labor’s fiduciary rule and the Volcker rule. Democrats are expected to vehemently defend them in the Senate.

The fiduciary rule legally and ethically binds financial advisors working with Americans on retirement accounts to act as fiduciaries to their clients. In other words, these advisors must act in the best interest of their clients in all cases, even if the advice provided would not benefit the advisor. Much of the industry is currently accountable to the slightly lower “suitability standard”

Peter Lazaroff provided a strong analogy for the difference between the fiduciary and suitability standards in Forbes.

House minority leader Nancy Pelosi lauded the DOL’s fiduciary rule in April 2016. “Americans scraping and saving for retirement deserve to know their financial advisor will help them safeguard their future,” she said. “Frankly, many Americans expect this already. The final fiduciary standard rule is a vital step forward that will strengthen the retirement security and confidence of every American.”

On the face of it, this rule, which is effective as of June 9 and will be enforced starting in 2018, seems to be a strong protection for consumers. That is, on the face of it.

The rule also creates miles of red tape and piles of paperwork for financial advisors that are likely to increase costs and decrease availability of investment advice, especially for Americans with lower incomes and smaller bank accounts.

The National Black Chamber of Commerce excoriated the rule back in 2015. The organization’s president and CEO, Harry C. Alford, wrote, “The new DOL regulations will likely result in fewer commission-based services in the marketplace, leaving only fee-based and managed account services that are not affordable options for many individuals in our communities.”

Nebraska Senator Ben Sasse also opposes the fiduciary rule, not just on practical concerns about its unintended consequences, but also on principle.

“This isn’t ‘middle-class economics,’” he said of the rule in an April 2016 press release, “it’s Washington elitism. The rule is built around the Administration’s arrogant assumption that Nebraskans need central planners to pick their financial advisors for them. While this may not harm everyone who can afford big name firms, it is going to make it significantly harder for small businesses and families to access sound financial advice.”

The DOL’s fiduciary rule might be a nice in theory, but like most government central planning, it’s destined to cause more harm than good. Unless, of course, it’s repealed.

The repeal of the Volcker rule promises to be just as controversial. The rule, named after former Federal Reserve chairman Paul Volcker, prevents proprietary trading by commercial banking institutions – think Glass-Steagall lite. Volcker argued that such risky trading – where banks invest for their own money for their own profit, or loss – helped lead to the 2008 financial crisis.

The issue with the Volcker rule is that it makes “capital formation” far more difficult and slows down lending and the growth of the economy overall. It’s also more unnecessary federal regulation.

So, what do we choose? Do we take the risk of another major crisis or just accept the same slow rate of growth caused by government meddling?

The Financial Choice Act attempts to find a happy medium. While it will permit proprietary trading from banks by repealing the Volcker rule, it also makes abundantly clear that there will be no more bailouts of “too big to fail” banks. Additionally, it provides regulatory exemptions for banks that, “choose to maintain high levels of capital.”

This gives banks the carrot of less regulation if they keep risk low and the stick of bankruptcy without a bailout if they take on too much risk.

Unfortunately, with just a slim Republican majority in the Senate, the Financial CHOICE Act is unlikely to make it to the president’s desk intact, and the repeals of the Volcker rule and the fiduciary rule are two likely casualties.

While we may not get all of these economic reforms immediately, it’s nice to finally have an administration trying to unshackle the economy rather than bury it in more and more rules.